Finding the best credit cards 2024 can be a fun journey! With so many options available, it’s important to know which cards offer the best rewards, low interest rates, and other great benefits. Whether you want to earn cash back, travel points, or just have a card for emergencies, there is a perfect choice for you.

In 2024, credit cards are getting even better. Many companies are adding new features to help you save money and earn rewards. This year, you might see cards with no annual fees, bonus offers, and special promotions. Understanding what each card offers is key to picking the right one for your needs.

Features to Look for in a Credit Card

When choosing a credit card, it’s important to know what features matter most. Here are some key things to consider:

- Annual Fees: Some cards charge yearly fees, while others do not.

- Interest Rates: Look for cards with low interest rates to save money on payments.

- Rewards Programs: Find cards that offer rewards for the things you buy often, like groceries or gas.

Additionally, some cards offer special perks like travel insurance or discounts on certain services. Understanding these features will help you find the best credit card for your lifestyle.

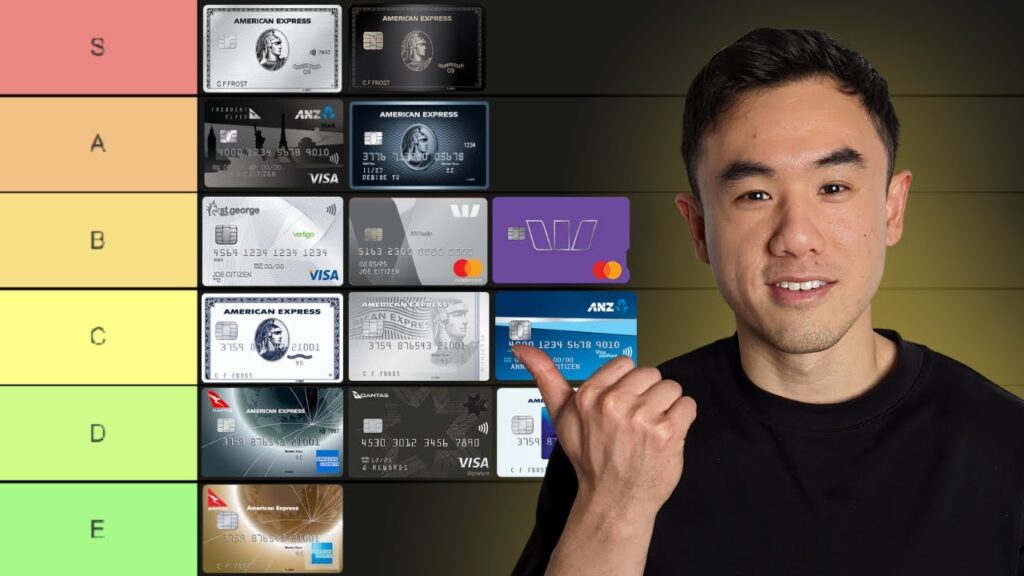

Popular Credit Card Options for 2024

In 2024, many credit cards stand out because of their benefits. Here are a few that are often recommended:

- Cash Back Cards: These cards give you a percentage of your spending back as cash. They are great for everyday purchases.

- Travel Rewards Cards: If you love to travel, these cards can earn you points for flights and hotels.

- Low-Interest Cards: Perfect for people who may carry a balance, these cards have lower interest rates.

Choosing the right card depends on how you spend and what benefits are most important to you.

Cash Back Cards

These cards are fantastic for earning money back on every purchase. With a cash back credit card, you might earn 1% to 5% back on specific categories like groceries or dining out. This means if you spend $100 at a grocery store, you could get $1 to $5 back!

Travel Rewards Cards

Travel lovers enjoy these cards because they earn points for trips. You can use these points to book flights, hotels, or even rental cars. Some cards also offer bonus points if you spend a certain amount within the first few months.

Tips for Using Your Credit Card Wisely

Using a credit card can be fun, but it’s important to use it wisely. Here are some tips to keep in mind:

- Pay Your Balance: Always try to pay your balance in full to avoid interest.

- Set a Budget: Keep track of how much you spend to stay within your budget.

- Monitor Your Spending: Check your statements regularly to ensure everything looks right.

Staying responsible with your credit card helps you enjoy the benefits without getting into debt.

In conclusion, finding the right credit card in 2024 can enhance your financial life. Consider the features, types of cards available, and best practices for usage. This will guide you in making an informed choice that fits your needs. Happy spending!

Conclusion

Choosing the right credit card is an important decision for 2024. A good card can help you buy what you need, earn rewards, and build your credit score. Always remember to think about what features you need most. Whether you want cash back, travel points, or low interest rates, there’s a card out there for you!

Using your credit card wisely is key to enjoying its benefits. Pay your balance on time and keep track of your spending. By being smart with your credit card, you can avoid debt and have fun with your rewards. Take your time to find the best option and make your money work for you!

FAQs

Q: What is a credit card?

A: A credit card is a payment tool that lets you borrow money from a bank to buy things. You pay the bank back later, usually with interest if you don’t pay the full amount each month.

Q: How can I choose the best credit card for me?

A: To choose the best credit card, think about your spending habits. Look for cards that offer rewards or cash back on things you buy often, and check the fees and interest rates to find the best deal.

Q: What should I do if I can’t pay my credit card bill?

A: If you can’t pay your credit card bill, contact your credit card company right away. They might help you set up a payment plan or lower your payment temporarily. It’s important to communicate and not ignore the bill.

Leave a Reply